EVERYTHING YOU NEED TO KNOW ABOUT MAKING TAX DIGITAL

Making Tax Digital is coming but not everyone is aware of how it will affect sole traders and landlords across the UK.

By the time you get to the bottom of this page, you'll have all the answers to any questions you may have, and be more prepared for these incoming tax changes.

YOUR MAKING TAX DIGITAL (MTD) GUIDE

The latest legislation

The MTD program that has being going for some years, although so far only VAT registered businesses have had to comply. That’s now changing and the latest legislation that will impact millions of businesses. But not everyone will be hit. This article explains whether and how you will be impacted.

Where does MTD come from?

Making Tax Digital comes from HMRC, aka the tax man. Businesses have to keep records of their business on a computer. This should help businesses to join the digital revolution and hence become more efficient.

Who is hit and when?

Partnerships and limited liability companies aren’t involved. Three deadlines, only impacting sole traders, have been announced. These come over a three-year period, based on the sales (not profit) from your business, added to any gross rental income from UK or overseas properties, making your total sales. PAYE, interest, pensions, capital gains and dividends must be declared but do not count towards your total business sales:

- For sales over £50,000 the compliance deadline is 6th April 2026

- For sales over £30,000, the compliance deadline is 6th April 2027

- For sales over £20,000, the compliance deadline is 6th April 2028

Almost every heating, plumbing and renewables business that is not a limited liability company will be caught.

What does this mean for me?

Compliance means you have to:

- Keep detailed digital records for both sales and costs on a computer

- Submit a quarterly summary for your business and each rental business to HMRC using MTD-compatible software

- Submit an annual tax return, again using MTD-compatible software

HMRC can provide an estimate of your tax payable each quarter and give the total CIS deductions that you may have suffered.

Can my accountant do it all for me?

An accountant or a bookkeeper can keep your digital records and submit the quarterly and annual returns on your behalf. You would need to send them details of all costs and sales at least quarterly. You would also need to send details of property rent and costs.

This is likely to cost more than you currently pay your accountant or bookkeeper.

What about DIY?

You can keep your own digital records, you will already have most of them already in Powered Now. The records must be submitted to HMRC through an MTD compatible system, which Powered Now will comply with. You could do this for quarterly returns with the annual return being done either by you or your accountant.

What software is required?

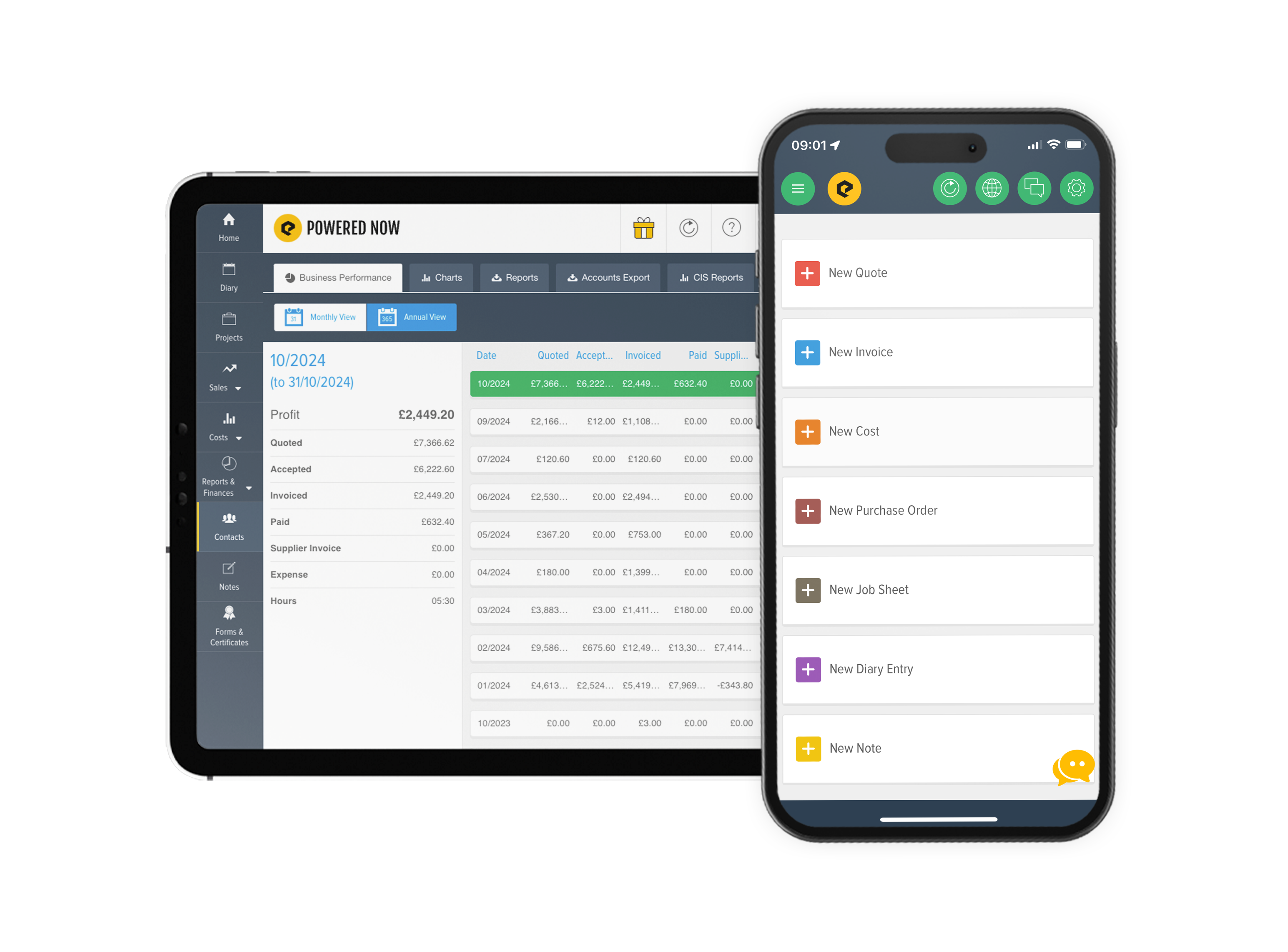

Most accounting packages will support MTD for IT and Powered Now will support all stages out of the box.

What about Powered Now's solution?

The Powered Now solution is currently under development. It will allow trade businesses that also optionally have UK and/or foreign rentals to comply with MTD for IT. They will be able to submit quarterly returns and their tax return directly to HMRC through MTD using Powered Now.

Further help

If you would like to learn how Powered Now can help, book a demo or start a free trial today.

Making Tax Digital explained

We know that Making Tax Digital can be confusing. That's why we created a video series to explain everything you need to know about Making Tax Digital, its changes, how to get MTD ready and the impact on your trade business.

What is Making Tax Digital?

Making Tax Digital (MTD) is the HMRC project designed to get all businesses and individuals to start keeping their accounting and tax records on a computer. MTD for VAT is already here and over the coming years, starting in April 2026, Making Tax Digital will include Income Tax Self Assessment.

What is MTD for ITSA?

Making Tax Digital for Income Tax Self-Assessment, also known as MTD for IT, will eventually require all self-employed people and landlords with sales of more than £20,000 per annum (that is businesses that aren't a limited liability company or equivalent), to keep digital records then submit quarterly sales and cost figures electronically. It starts in April 2026 for sole traders with total sales over £50k, then comes in for people with sales over £30k in 2027 and finally those over £20k in 2028.

How will MTD for IT impact me?

Making Tax Digital for Income Tax Self Assessment, means that you or your accountant will need to keep records of your costs and sales digitally - that is on a computer or smartphone. Then this software must be able to submit quarterly summary figures and you also need you or your accountant to submit your final tax return through software.

MTD for IT - what do I need to do now?

Business owners and landlords will no longer file an annual self-assessment tax return in the old way, unless you are specifically exempt from MTD for IT. You must use software recognised by HMRC.

THE LATEST MAKING TAX DIGITAL NEWS

Get insights, hints and tips from experts to help you get Making Tax Digital ready. Read more about Making Tax Digital on our blog.

How to calculate MTD?

The Making Tax Digital initiative is the latest step in a series of government measures designed to support small businesses and improve their performance. It initially only applied to VAT-registered businesses, but from April 2026 to 2028 it will apply to most business that are sole traders i.e. not limited liability companies.

What is MTD for VAT?

You may be wondering what Making Tax Digital for VAT is and how it will affect your business. To put it simply, it is the process of bringing the tax system into the digital age.

MTD deadlines - Key dates to know

Deadlines can cause stress but don’t worry, here we explain the MTD deadlines that are coming up so you can stay compliant ...

Why is MTD being introduced?

The Government wants to make accounting data more accessible to taxpayers. Companies need to transfer paper receipts as soon as possible to accounting software.

When does MTD start?

MTD for VAT started for compulsorily registered VAT businesses for the first VAT return done on or after 1st April 2018. MTD for Income Tax (for sole traders) starts in April 2026 with a series of deadlines over three years ...

What are the penalties for non-compliance with MTD?

Penalties for failing to file MTD for VAT returns on time will follow a points system. There are unlikely to be fines for non-compliance with MTD in the first year when the business has made reasonable efforts to comply.

MTD for Income Tax Self Assessment - what it means for your business

MTD is a massive years-long programme to make all things related to tax move into the digital age. This should eventually result in many improvements.

Making Tax Digital and the role of your accountant

MTD, or Making Tax Digital is going to have an impact on virtually EVERY sole trader business over the next few years (i.e. not a limited liability company). But it’s not only businesses, it will also make a big difference to the way that accountants support their clients.

The basics of VAT in the trade industry

VAT is “Value Added Tax”. This is a tax which every business with sales over £90,000 must add to their sales invoices.

For example, an electrician does a job where they buy £1,000 of materials with £200 VAT at 20%, giving a total materials bill to be paid of £1,200. They do £5,000 worth of labour so they charge £1,000 + £5,000 = £6,000 then add £1,200 VAT at 20%, giving a total bill to the customer of £7,200.

MTD Practical Guide

Learn more about Making Tax Digital (MTD) for VAT, Income Tax Self Assessment and Corporation Tax with Powered Now MTD Practical Guide.

MAKING TAX DIGITAL FAQS

What is Making Tax Digital for VAT?

Making Tax Digital for VAT, also known as MTD for VAT, is the process of bringing the VAT system into the digital age. All VAT-registered businesses are required to use MTD for their VAT returns. This means, using compatible software like Powered Now to keep digital records and submit VAT statements to HMRC. Make sure you've got the right software for your business.

What is MTD compatible software?

MTD compatible software is software that allows you to keep digital records and submit VAT Returns and/or Sole Trader Income Tax returns without needing to visit HMRC’s website. HMRC has recognised a number of compatible software apps that you can use for Making Tax Digital tax returns to HMRC.

When should you start preparing for MTD for ITSA?

MTD for ITSA starts coming in from 6th April 2026, with small sole traders with total sales over £50,000 per annum being the first to be included.

Here's how to get started:

MTD for ITSA will require you to keep digital records of your business's income and expenses, including property income. You then need to use software to make quarterly sales and cost returns to HMRC as well as your tax return. This means that you'll need software that's compatible with MTD and you need to use this to submit these digital records to HMRC. Make sure you do your research and find compatible software that suits your business needs.

The deadline for actually submitting your final tax return is the 31st of January of the following year. You'll have until midnight on the same day to make your final declaration and pay your tax. You should also prepare any staff that you may have for the change. And there's no need to stress about it, just get started as soon as possible.

How will Making Tax Digital benefit my business?

MTD could be a good opportunity for your business. As you will be keeping records and filing taxes digitally, it will give you the chance to check your income, expenses and profit on a regular basis and this can help you make informed decisions. You’ll have a clear view of your tax obligations and access to your tax information online from anywhere.

What do I need to do to be ready to sign up for Making Tax Digital for VAT?

You need to choose software that is compatible with Making Tax Digital. This is critical to ensuring compliance with the regulations. If you are VAT registered you need it to submit your VAT Return through MTD. If you are a sole trader you will most likely need to submit quarterly returns and your final tax return through MTD, with deadlines for different sized businesses in 2026, 2027 and 2028. For either MTD service you will need a Government Gateway User ID and password (if you don't have one, you can create one when you sign up).

Powered Now, for example, is cloud-based software that allows users to manage accounts from any device. With Powered Now you can create invoices, quotes, expenses, purchase orders and submit your VAT directly to HMRC, keeping on top of your numbers with ease and will shortly be able to submit MTD IT returns too.

You can find more information on how to sign up for Making Tax Digital for VAT here.

When is MTD happening?

HMRC is introducing Making Tax Digital gradually. Here you can find Making Tax Digital key deadlines.

USE POWERED NOW FOR MTD

Powered Now is the only affordable and easy to use app that lets you run your trade business on the go.

One tool, everything in one place.

QUESTIONS? VISIT OUR SUPPORT PAGE TO FIND OUT MORE

“It’s so brilliant to be able to present customers with digital forms and certificates straight away. This has been particularly useful when carrying out gas checks on properties with absent landlords or doing gas safety surveys on properties on behalf of estate agents and solicitors. Within minutes of me finishing the check the landlord or solicitor can have a safety certificate in their hands. As a result they’re more likely to pay the bill – and give me repeat business."

“If our customers misplace their reports or their certificates, we can get them replacement copies with the push of a button. Having everything in one place helps us be more responsive to customer requests and queries.”

"Easy to use and has changed my whole thinking of running my business and with certificates as well it’s just an all round brilliant app."